One day after TCS announced its results, TCS stock rose by 6.59%, and the broader Nifty IT index grew by 4.53%. India’s largest English-language business and finance news channel highlighted this with the message: “Good Q1 for IT bellwether TCS.”

In this commentary, we remove all the froth and focus on data. Let’s dive deep into it.

Key highlights as per the fact sheet issued by TCS:

Revenue at US$7.51 billion

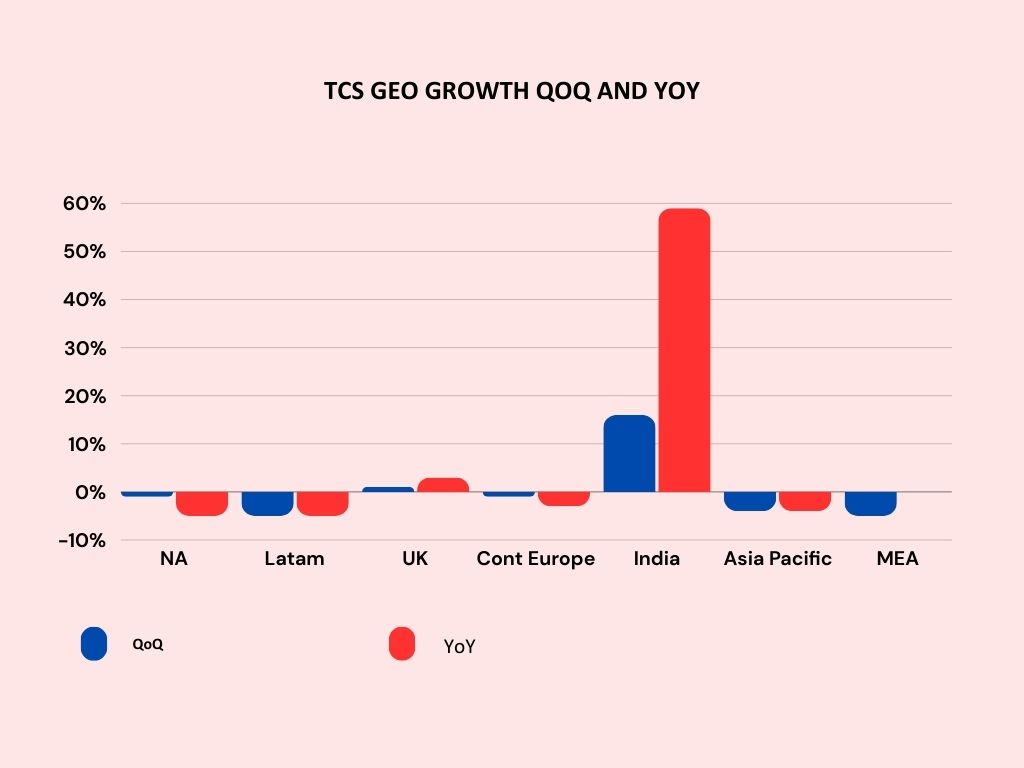

All Major Markets Return to Sequential Growth; Very Strong Double-digit growth in Emerging Markets, led by India (+61.8% YoY)

Almost all Verticals Return to Sequential Growth; YoY Growth led by Manufacturing (+9.4%), Energy, Resources & Utilities (+5.7%), and Life Sciences & Healthcare (+4.0%)

Operating Margin at 24.7%; Net Margin at 19.2%

Net Headcount addition of 5,452; LTM Attrition further down to 12.1%

What’s the story behind the numbers? Let’s look at it in detail.

Revenue Growth

- Revenues stood at $7.51 billion, a growth of over 2% from the previous quarter. This is the best QoQ growth rate the company has seen since Q4 FY23.

- Management reiterated that the focus is on cost optimization, and discretionary spending is on hold. This mirrors Accenture’s narrative and growth story, which saw around 4% QoQ growth in constant currency.

Deal Wins

The Total Contract Value (TCV) metric gives confidence in medium to long-term growth potential.

- The Q1 FY25 order book stood at $8.3 billion, a significant dip in recent quarters. Over the past five quarters, barring Q3 FY24 and this quarter, TCV has been in double digits.

- TCS achieved a record high quarterly order book of $13.2 billion in Q4 FY24. On a YoY basis, TCV has fallen from $10.7 billion in Q1 FY24.

Management has taken a cautious approach to conversion.

With Accenture eating into managed services revenues of its competition, could this be the beginning of a slowdown in the order book?

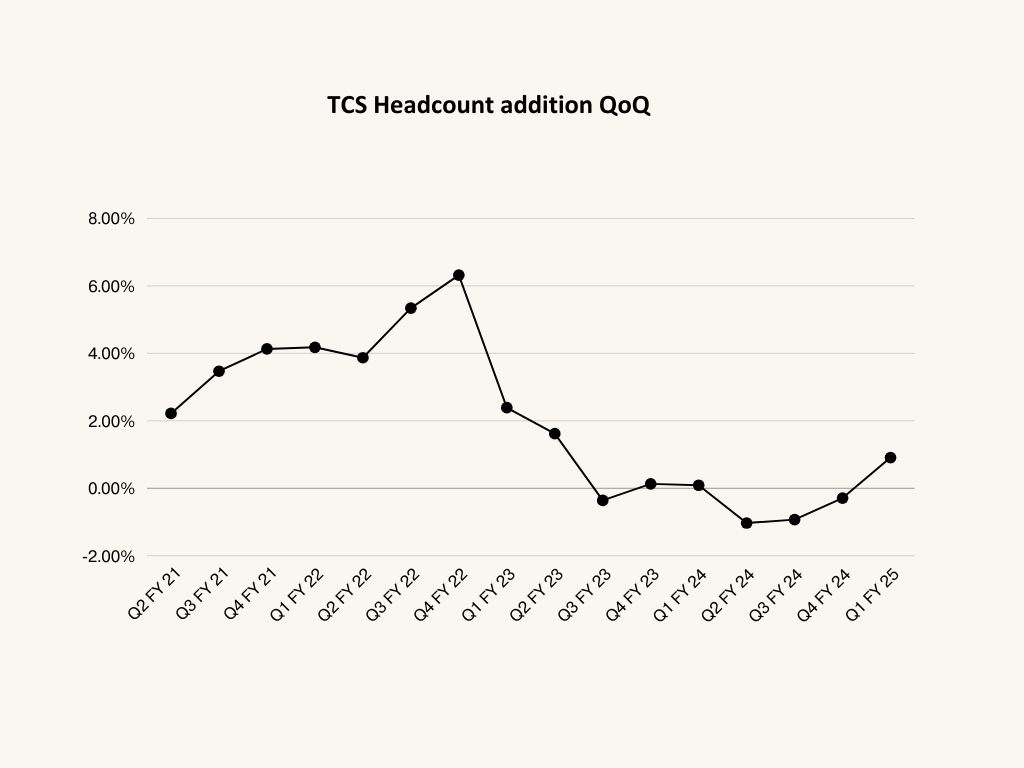

Headcount

- TCS’s workforce stood at 606,998. After three quarters of negative QoQ growth, the company finally had a positive net addition, largely driven by the addition of 11,000 freshers.

Without this addition, it could have been a case of negative to flattish growth.

- Attrition was at a comfortable 12.1%, reaching Q2 FY22 numbers of 11.9%.

Verticals outlook

- The core markets that were driving growth earlier are now experiencing turbulence, with regional and emerging markets holding steady.

- From a TCV perspective, BFS has seen a steady decline from $3 billion in Q1 FY24 to $2.7 billion now, and the consumer business has seen a significant drop from $1.6 billion in Q4 FY24 to $1.1 billion now.

- Overall, North America TCV is showing significant weakness, with a drop of over $1 billion between subsequent quarters.

Geography

For the first time, the share of North America has gone below 50% of total revenue with negative growth. While the UK remains flat, key growth has come from India.

Emerging trends in GenAI

Management acknowledges that GenAI/AI projects are gaining customer interest. The AI/GenAI projects pipeline has increased to $1.5 billion compared to $900 million last quarter. However, they were unwilling to provide more details about the revenue size of each project.

In Summary,

- Management is cautiously optimistic, consistent with Q4 FY24 results, emphasizing that cost optimization is a key priority for their customers.

- TCV growth has dipped. A cut in Fed rates is needed. The share of revenues from North America is slowly dipping. BFSI and consumer businesses have seen the biggest fall. For TCS to regain its past glory, this geography needs to show growth.

- I am not overly exuberant about the results.

- Perhaps the stock prices are factoring in a revival, or the sector has lagged for a long time, and any good news is seen as a complete revival.

You can find detailed version of this commentary at insightsandintel.com

I value your feedback. If you found this analysis helpful or have suggestions for improvement, please let me know at insightsandintel@gmail.com

Thank you for your support.

Data source: website of Tata Consultancy Services

Disclaimer: The views expressed in this post are personal and do not reflect those of my organization.