Infosys announced its Q1 FY25 results on Thursday, July 18, 2024. The Infosys stock price spiked 9.7% from July 12 to July 19, one day after TCS announced its results. Management revised revenue growth projections to 3%-4% from the earlier estimates.

Key Highlights from the Company Fact Sheet for the Quarter Ended June 30, 2024:

- Revenue Growth: Revenues in constant currency (CC) terms grew by 2.5% YoY and by 3.6% QoQ. Reported revenues were $4,714 million, a growth of 2.1% YoY.

- Operating Margin: Operating margin stood at 21.1%, showing growth of 0.3% YoY and 1.0% QoQ.

What’s the story behind the numbers? Let’s look at it in detail.

Revenue Growth

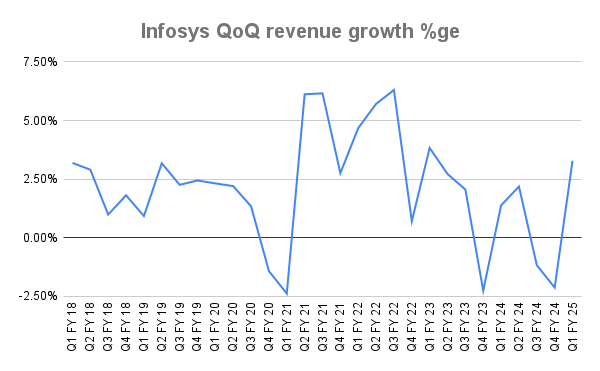

- Revenues stood at $4.71 billion, a growth of 2.5% YoY and 3.6% QoQ in CC terms. This marks the best QoQ growth rate the company has seen since Q1 FY23, and a turnaround from two quarters of negative growth.

- Management mentioned they are seeing cautious growth with clients focusing on digital transformation, mirroring the narrative of TCS and Accenture.

Deal Wins

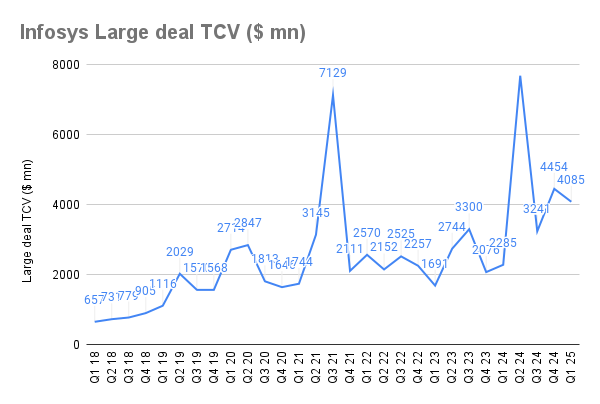

- The Total Contract Value (TCV) of large deals stood at $4.1 billion, slightly lower than the Q4 FY24 figure. However, barring two spikes, the TCV of large deals is increasing.

- Out of the 34 deals announced, 8 each were from Communications and Retail, and 5 from BFS.

- Geographically, 21 deals were from North America and 12 from Europe.

Headcount

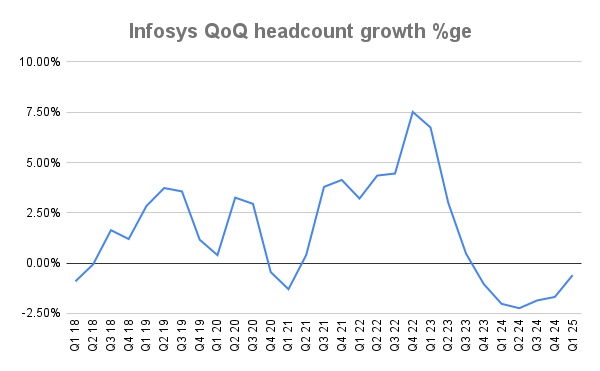

Infosys’ workforce stood at 315,332, marking the sixth sequential quarter of headcount decline. However, the rate of decline is reducing. Attrition was at a comfortable 12.7%, remaining steady for the past few quarters.

Verticals Outlook

- BFS: North America has seen a slight uptick.

- Consumer and Communications: These sectors are seeing softness.

Geography

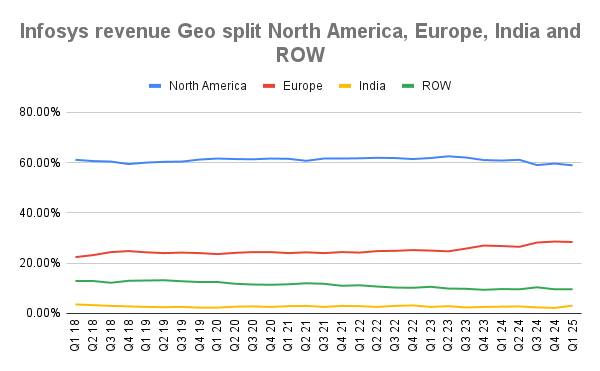

For the first time, the share of North America has hit its lowest in the past 6 years, showing a gradual decline. The share of Europe has grown to a steady 28%. Notably, in Q1 FY25, Infosys announced close to 10 deals in the public domain.

Emerging Trends in GenAI

Management did not provide much detail about revenues or pipeline from AI but acknowledged that GenAI/AI projects are gaining customer interest.

In Summary:

- Management is cautiously optimistic, raising guidance. Key contributors to growth include Project Maximus and inflows from recent acquisitions, indicating technically muted to slightly better growth.

- Management expects H1 to be better than H2 but did not provide much clarity on the recovery in the Consumer and Communications verticals.

- Similar to other competitors, growth is dependent on rate cuts by the Fed. Concerns remain about whether Fed rate cuts will translate to increased discretionary spending!

I value your feedback. If you found this analysis helpful or have suggestions for improvement, please let me know.

Thank you for your support.

Data source: website of Infosys

Disclaimer: The views expressed in this post are personal and do not reflect those of my organization.